A simple but powerful way to read intention, accumulation behavior, and intraday support creation through bid walls.

Have you ever watched the tape and thought, “Why does price refuse to break this level even with heavy selling?” or “Why do gigantic bids suddenly appear and stay there like a wall?”

This strategy explains exactly that. It is built on three core pillars:

- Identify the bid wall being defended

- Identify whether accumulation is happening behind it

- Trade the breakout or fade once the wall succeeds or collapses

🧱 1. Identify the Bid Wall Being Defended

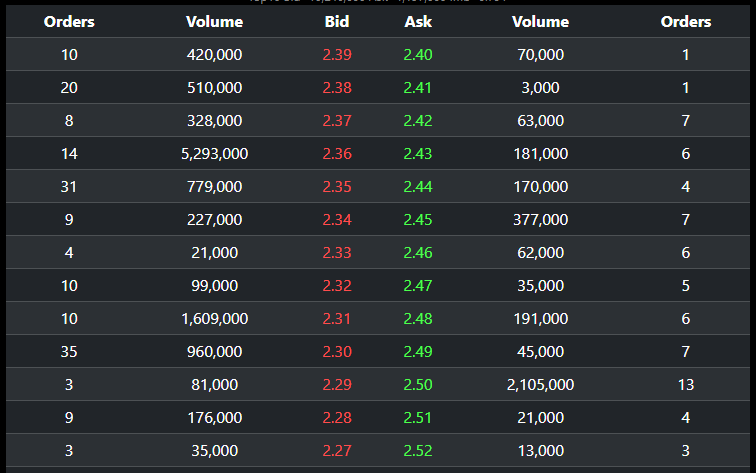

A bid wall is a cluster of unusually large buy orders sitting at one price level — often far larger than the surrounding liquidity. For example, you see these large buy orders in the orderbook:

- 5,293,000 shares at 2.36

- 3,454,000 shares at 2.10

- 1,695,000 shares at 2.00

These bid walls act like intraday floors. They are not random. They represent someone who:

- needs to accumulate size,

- must hold a position above a certain average price,

- or is defending a level for strategic reasons.

How to confirm a real bid wall (vs. a fake one)

- The wall stays even when sellers attack it

- The bid refills after being partially eaten

- Trades hit the bid but price does not break

- Order count is high — the wall is layered, not just one spoof order

When you see a real bid wall, you mark it as the defending price. This becomes your key decision-making level.

🧱 2. Identify Accumulation Behind the Wall

A bid wall is only valuable if it is backed by real accumulation. The order book shows the intention, but Time & Sales shows the truth.

Signs of accumulation behind the bid wall

- Repeated small-to-medium prints hitting the bid without breaking it

- One broker consistently absorbing at the defending price

- Bid replenishment — the wall refills after each attack

- Price attempts to break lower but gets rejected instantly

In the screenshot above, imagine price hovering above 2.36 while sellers continuously test the level — but the 5.29M bid never collapses. That is textbook accumulation behavior.

Where accumulation usually comes from

- Funds averaging down into a larger intraday or swing position

- Foreign brokers accumulating slowly through algorithms

- Smart money absorbing weak-hand selling

Once you spot both the wall and the absorber, you know exactly who is shaping the market — and what level they care about.

🧱 3. Trade the Breakout or Fade Based on the Wall’s Success or Collapse

This is where the setup becomes actionable. A bid wall gives you two high-probability trades:

A. Trade the Breakout (when the bid wall holds)

Buy when:

- Price stops making lower lows above the wall

- T&S shows selling absorption but no breakdown

- Ask levels begin to thin out or get eaten

- A higher high forms above the micro-range

Stop-loss: Just below the bid wall.

If the wall breaks, your thesis is invalid.

B. Trade the Fade (when the wall collapses)

Short or exit when:

- The bid wall suddenly disappears

- T&S shows a large sell burst that slices through the wall

- Accumulating brokers turn into net sellers

- Next liquidity layer is far below (liquidity vacuum)

When a major bid wall finally breaks, price often accelerates downward because liquidity underneath is thin.

This is a high-quality fade opportunity.

🔁 Why This Strategy Works

Smart money cannot accumulate size at random prices. They need:

- a stable level,

- consistent liquidity,

- and controlled downside risk.

The easiest way to achieve that is by defending a bid wall.

This pattern reveals:

- Where they are buying

- How urgently they want the position

- Which level they cannot allow to break

Once you identify where smart money is accumulating, your goal becomes simple:

Trade in alignment with the wall — or take the reversal when it finally gives up.

🚀 Putting It All Together

- Mark the bid wall. This is your intraday floor (ex: 2.36).

- Check T&S to confirm accumulation. Defense means intention.

- Trade the outcome:

- Breakout = wall holds → go long

- Fade = wall collapses → short into vacuum

🧠 Final Thoughts

Bid walls show you where smart money is building a position long before the chart shows any pattern. You are not guessing — you are observing their footprints live.

When you learn to read these walls the way institutions use them, the market stops feeling chaotic and starts making sense.

🚀 Ready to Learn These Strategies From Me Directly?

The Bid Wall Accumulation Strategy is one of the core setups I teach inside my Orderflow Trading Lifetime Mentorship Program. If you want to master tape reading, broker flow analysis, and live execution, I welcome you to reach out.

📩 Email me to enroll: myactualtrades@gmail.com

Or message me on Facebook: facebook.com/pedro.the.trader

Spaces in the mentorship are limited to ensure each member receives one-on-one guidance.