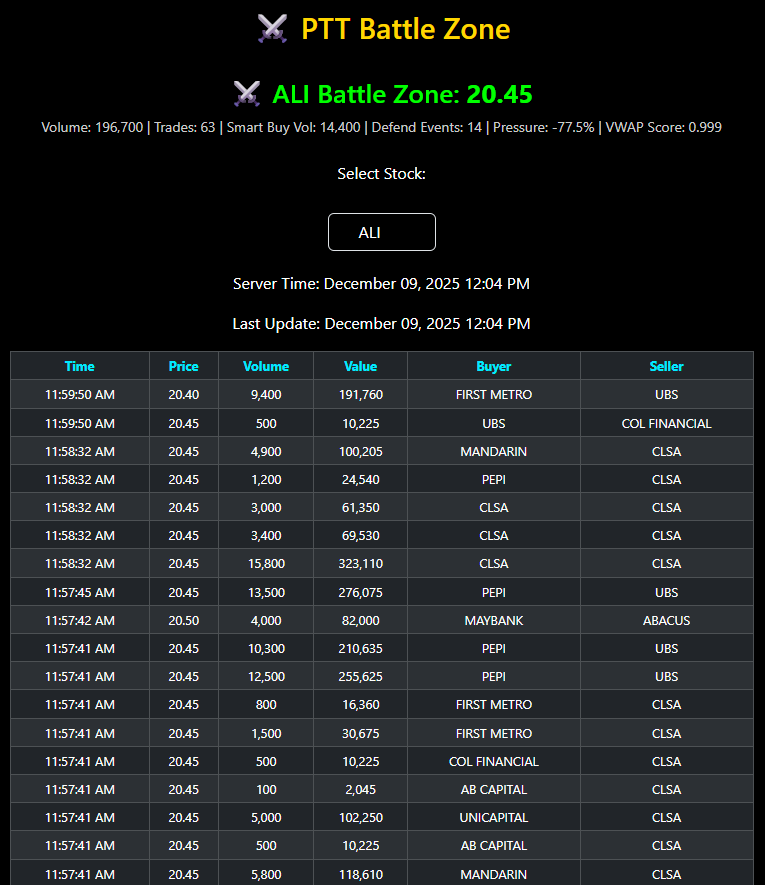

An easy way for new traders to understand how smart money reveals the strongest intraday level — and how the PTT Battle Zone helps you time entries and exits with confidence.

Have you ever looked at a stock and wondered, “Where should I actually buy?” or “Which price level matters the most for today?”

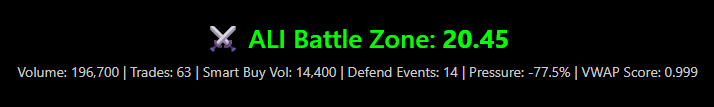

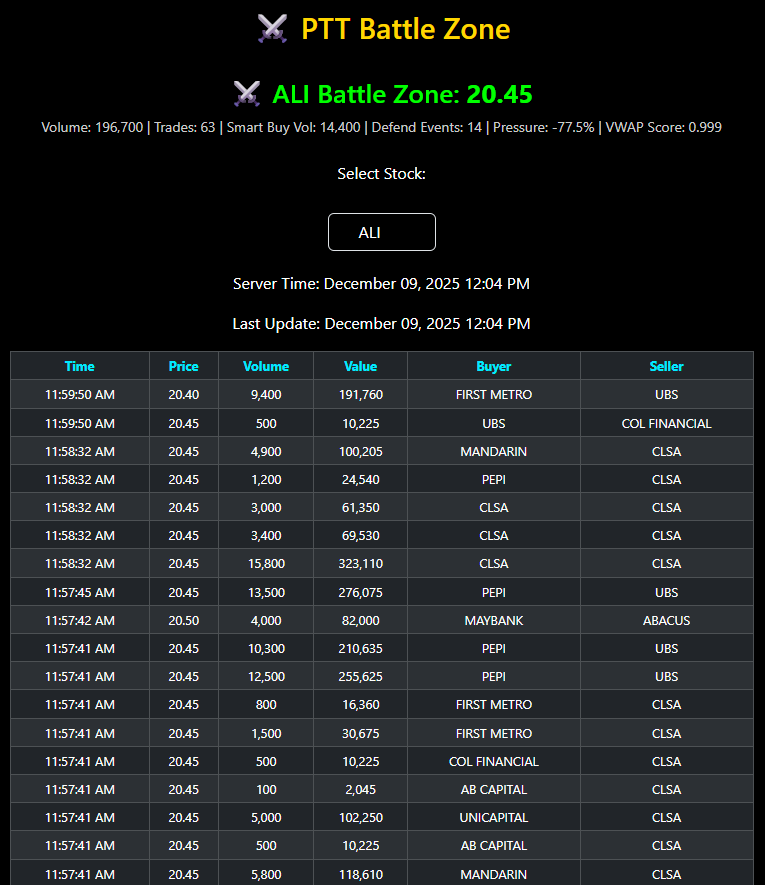

The PTT Battle Zone tool answers these questions by analyzing real-time trades, smart-broker behavior, and repeated absorption patterns.

This guide explains how to read the Battle Zone and use it for intraday trading. It revolves around three core ideas:

- Find the price level where heavy defense keeps happening

- Understand why that level matters in the first place

- Use the zone as your timing guide for entries, exits, and trade validation

🧱 1. Find the Price the Market Keeps Defending

Every intraday trend starts from a level where buyers or sellers repeatedly show up. The Battle Zone algorithm identifies this by studying:

- Where most trades occur — high activity means high interest.

- Where dips are absorbed — price goes down, but buyers catch it and push back.

- Where smart brokers consistently buy — institutional-style behavior stands out.

- How aggressively buyers or sellers push at that level — measured through tape pressure.

The app scans every trade of the day and looks for a repeating pattern:

- Price dips →

- Buyers absorb →

- Price recovers

When this happens multiple times on the same price, that level becomes the strongest candidate for the Battle Zone.

This is where the market tells you:

“Someone is defending this area.”

🧱 2. Why This Level Matters for Your Trades

The Battle Zone is not just “support.” It’s the product of multiple types of real buying activity:

- Smart-buy volume — select brokers known for institutional behavior.

- Aggressive buying — trades that push the price upward.

- Absorption (defend events) — large sell volume gets eaten instantly.

- VWAP proximity — smart money often accumulates near fair value.

When all these factors combine, it creates a zone where:

- Price stops falling

- Buyers regain control

- Momentum begins to shift upward

For a newbie trader, this simplifies the entire decision-making process.

Instead of guessing where support might be, the app tells you:

“This is the level where strong hands stepped in today.”

This becomes your anchor for timing each trade.

🧱 3. How to Use the Battle Zone for Entries & Exits

Once the Battle Zone appears on the app, here’s how a newbie PSE trader should use it:

A. Using the Battle Zone for Entries

Enter when:

- The price dips into the Battle Zone and holds instead of breaking.

- You see strong buying or a familiar broker name defending the area.

- The stock forms a higher low or attempts a breakout after touching the zone.

- Volume shifts from selling → buying, confirming the defense.

This gives you an entry with:

- Low risk (your stop is just below the zone)

- High probability (buyers already showed interest earlier)

B. Using the Battle Zone for Exits or Avoiding Trades

Sell or stay out when:

- The price falls below the Battle Zone with strong selling pressure.

- The defending broker disappears or flips to heavy selling.

- Absorption stops happening — the tape no longer shows defense.

If the zone breaks, the message is simple:

“Smart money is no longer defending — avoid the long trade.”

🔁 Why the Battle Zone Gives an Edge to New Traders

Most newbie PSE traders struggle because charts don’t show who is behind the move.

The Battle Zone solves this by reading behavior that cannot be hidden:

- Repeated defenses

- Smart-broker accumulation

- Aggressive pressure shifts

- Volume concentration where real transactions happen

Instead of guessing:

- Where is support?

- When should I enter?

- Is this breakout real?

…the tool gives you an objective level rooted in actual orderflow.

🚀 Putting It All Together

- Watch the Battle Zone level displayed at the top of the app.

This is the most defended price based on real trades. - Buy only when the price reacts positively at that level.

A bounce with strong buying is your confirmation. - Avoid trades when the Battle Zone breaks.

If smart money doesn’t defend, you shouldn’t risk it.

By following these simple steps, even a beginner can trade around institutional behavior instead of guessing.

🧠 Final Thoughts

The Battle Zone gives you a clear, data-driven way to see where strong traders stepped in.

It removes uncertainty, lowers risk, and helps you time entries and exits with structure.

When you understand how defense, absorption, and smart-broker flow shape intraday movement, trading becomes clearer and more consistent.

🚀 Want to Learn How to Use Broker Flow and Orderflow in Real-Time?

The Battle Zone logic is one of the core tools I teach inside my Orderflow Trading Lifetime Mentorship Program.

If you want to master tape reading, broker flow analysis, and live execution in the PSE, I invite you to reach out.

📩 Email me to enroll: myactualtrades@gmail.com

Or message me on Facebook:

facebook.com/pedro.the.trader

Slots are limited so each trader receives proper guidance and feedback.